Published: 28.02.2020, 13:49

Published: 28.02.2020, 13:49 2 min read

2 min readGreat Britain’s non-departmental Gambling Commission has published the research on the mobile gambling players, and the numbers are trending upward. Every second player in Britain visits the online casinos from a smartphone, says the annual report released this week.

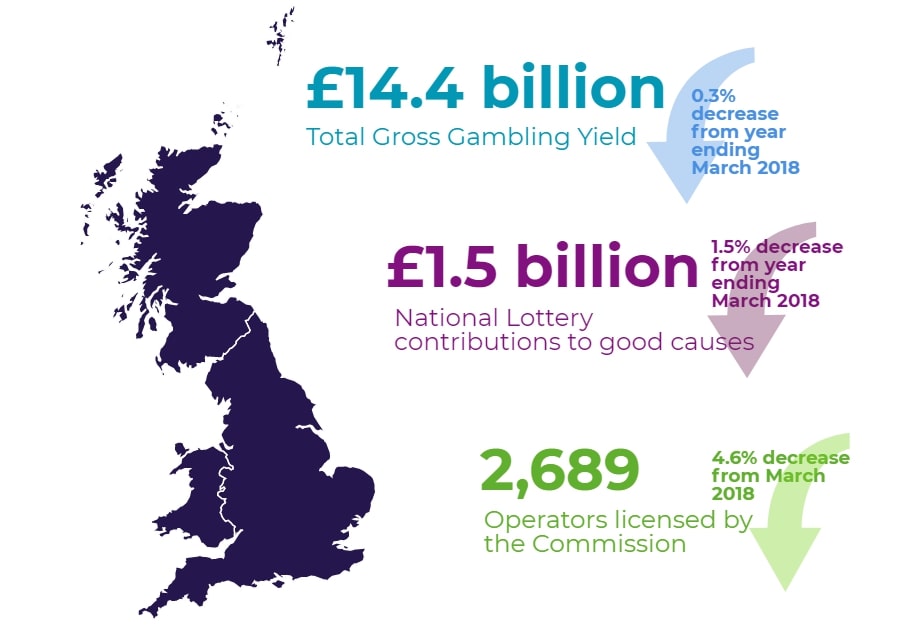

The GC’s report provides an overview of Gross Gambling Yield (GGY) rates by sector, along with the data from licensed operators, premises, and industry employees. Including the historical statistics back to 2009, the research shows not only a marginal decrease of -0.3% but also acknowledges the online gambling as the largest sector by revenue. The total industry yield stood at £14.4bn.

UK total gross gambling yield of 2019. Source: UKGC

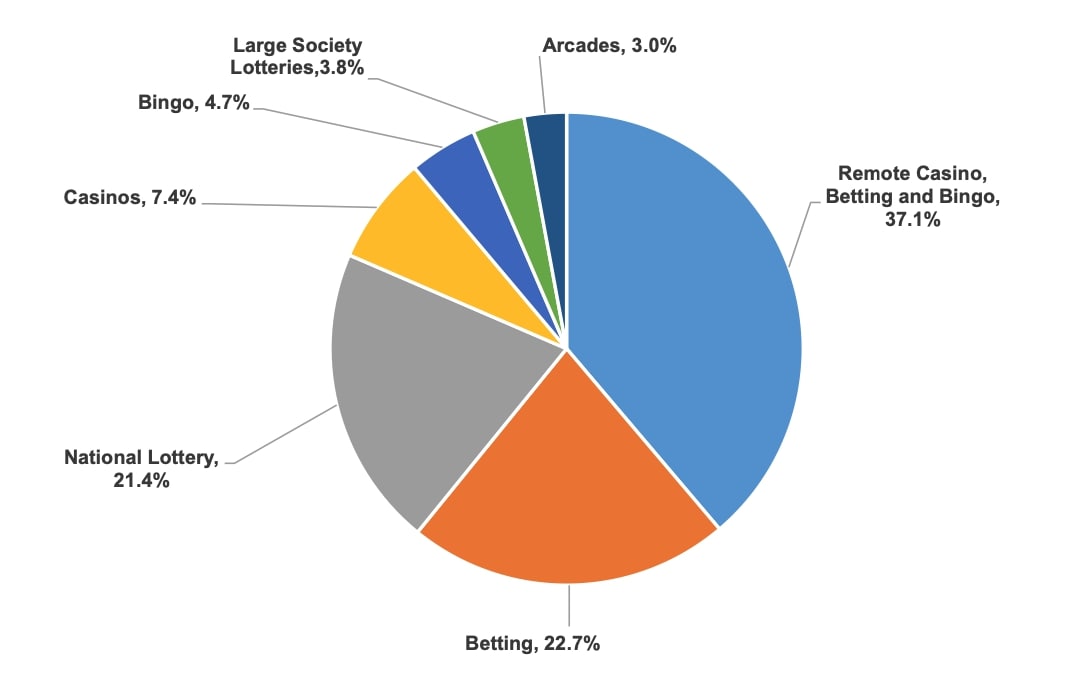

We can see the overall dynamics and trends by key figures of each sector. While the online betting, bingo, and casino games market share remains stable (about 37%), the non-remote casino sector saw a decrease of -10.3%. Despite the rapid National Lottery sales increase (by £7.2m), the sector is still in the third position. Football and horse racing also remain the most popular sport betting activities.

Meanwhile, non-remote betting is in second place with machines making the GGY decrease for the first time in 10 years. It goes around £7.2m.

Historically, over the past ten years, large society lotteries and arcades had the smallest market shares. Somehow, the report says that their GGY equivalent increased to £541.6m, or about 6,6%. The last reporting period shows that this is the highest contribution figure ever recorded. Arcades already mentioned previously showed a slight increase in the adult gaming centers, reporting +3.2% growth. Although the data doesn’t include non-licensed family entertainment centers, the dynamics are quite clear.

Gambling Commission’s research also shows that machines showed rising percent in the Gross Gambling Yield, except B2 and D categories. Let the numbers talk: while B2 machines had shown a -30.6% decrease, B3 category positions had almost doubled by £518m to £1.1bn.

Due to the relative data, in March 2019, there were a total of 2690 licensed operators, and every tenth had operated across more than one sector. Both online and non-remote entities conducted over 3600 activities, compared with around 3800 activities in 2018. Across Great Britain, licensed operators had used 10,761 gambling premises in March 2019, compared with 11,115 (-3.2%) in March 2018. There also were over 50 000 premises in the areas where gambling is legal and controlled by licensing authorities.

UK gambling industry GGY by different sectors.

The Gambling Commission’s report on the licensing authorities (LAs) also shows the regulation dynamics due to the Gambling Act in Great Britain. In the last five years, LAs reported that over 2800 permits were issued or notifications received. It also says that there is a test growth by 77 percent growth on the purchasing visits, and follow-up inspections decrease by 21 percent. As we can see, the regulatory issues are not the case for Great Britain’s gambling policy and regulations.